Homeowners Insurance cancellation letter is an essential aspect of protecting your home, family, and personal belongings from unforeseen damage or destruction. However, there may be instances when you need to cancel your insurance policy. This could be due to various reasons such as relocating, downsizing, or finding a better deal elsewhere. Whatever the reason may be, it is crucial to write a professional and appealing cancellation letter to your insurance provider. This not only ensures that the cancellation process is seamless but also leaves a good impression for future transactions.

A professional and appealing cancellation letter is critical because it demonstrates your professionalism and respect for the insurance company. Your letter should be concise, clear, and respectful. This creates a positive image of you as a responsible customer who values their business relationship with the insurance provider. Additionally, a well-written cancellation letter makes it easier for the insurance company to process your request and close out your policy. This saves both parties time and effort.

In contrast, a poorly written cancellation letter could create a negative impression and even lead to delays or complications in the cancellation process. Moreover, a good complaint letter could create a significant impact on the quality of service you receive from your insurance provider.

By providing constructive feedback and expressing your concerns politely, you can help the company identify areas for improvement and enhance their services. Therefore, it is crucial to write a clear and concise complaint letter that outlines the issues you faced and provides suggestions for improvement. In this article, we will explore the importance of a well-crafted Homeowners Insurance cancellation letter and how it can impact your future relationship with your insurance provider.

How To Write Homeowners Insurance Cancellation Letter?

If you need to cancel your homeowners insurance policy, it’s important to do so in writing. Writing a well-crafted cancellation letter can help ensure a smooth and hassle-free process.

Here are 5 steps on how to write the best homeowners insurance cancellation letter:

- Start with a clear and concise statement of your intent to cancel your policy. Include your policy number, name, and address to make it easier for the insurance company to identify your account.

- Provide a reason for the cancellation, if desired. While it’s not necessary to give a reason, doing so can help the insurance company improve their services in the future. Keep it brief and to the point.

- Specify the date you want the cancellation to take effect. This can be the current date or a future date, depending on your needs.

- Request a confirmation of the cancellation. This can be done via email, phone, or mail. It’s important to have a record of the cancellation for your own records.

Conclusion: Writing a well-crafted homeowners insurance cancellation letter can help ensure a smooth and hassle-free process. By following these five steps and providing clear and concise information, you can effectively communicate your intent to cancel your policy and request confirmation of the cancellation.

Homeowners Insurance Cancellation Letter Format

| [Your Name] | [Your Address] | [City, State ZIP] |

|---|---|---|

| [Date of Letter] | [Insurance Company Name] | [Insurance Company Address] |

| [City, State ZIP of Company] | ||

| [Policy Number] |

Dear [Insurance Company Name],

I am writing to request the cancellation of my homeowners insurance policy with your company, effective [Date of Cancellation]. Please find the details of my policy below:

| Coverage Type | Policy Term | Premium Amount |

|---|---|---|

| [Insert Coverage Type] | [Insert Policy Term] | [Insert Premium] |

I have enclosed a copy of my current insurance policy and proof of coverage from my new insurance provider. Please refund the unused portion of my premium to the following address:

[Insert Mailing Address for Refund]Thank you for your prompt attention to this matter. Please send written confirmation of my cancellation to the address listed above.

Sincerely,

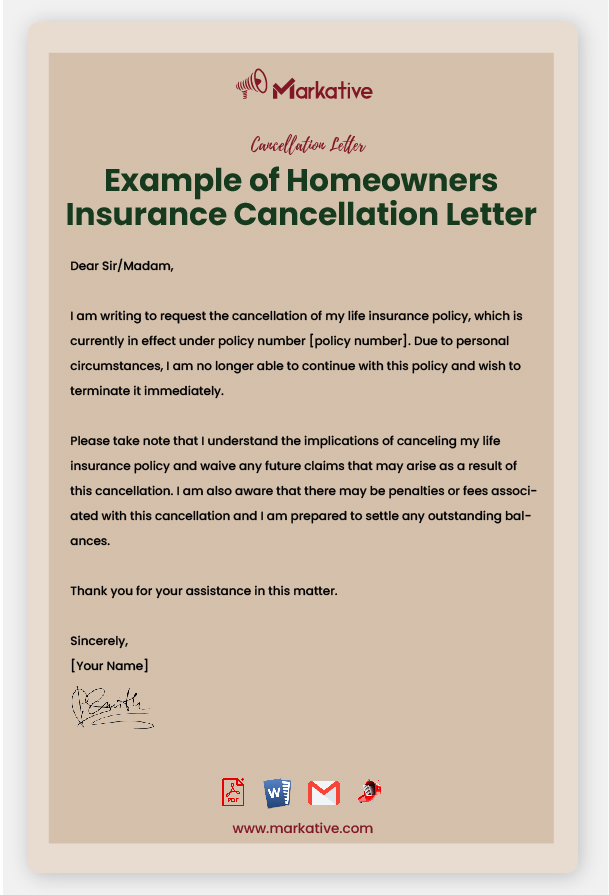

[Your Name]Example of Homeowners Insurance Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Your Email Address] [Today’s Date] [Insurance Company Name] [Address] [City, State ZIP Code] Re: Cancellation of Homeowners Insurance Policy Number [Policy Number] Dear Sir/Madam, I am writing to request the cancellation of my homeowners insurance policy number [Policy Number]. I regret to inform you that I will no longer require your services as I am moving out of the property on [Move-Out Date]. I request you to please cancel my insurance policy effective from [Cancellation Date]. I would appreciate it if you could confirm the cancellation and provide me with any necessary instructions to return any insurance documents and refund of any premiums that may be due. Please send any correspondence regarding this matter to my address listed above or email me at [Your Email Address]. Thank you for your prompt attention to this matter. Sincerely, [Your Signature] [Your Name]

For More: Best Life Insurance Cancellation Letter [5+ Templates]

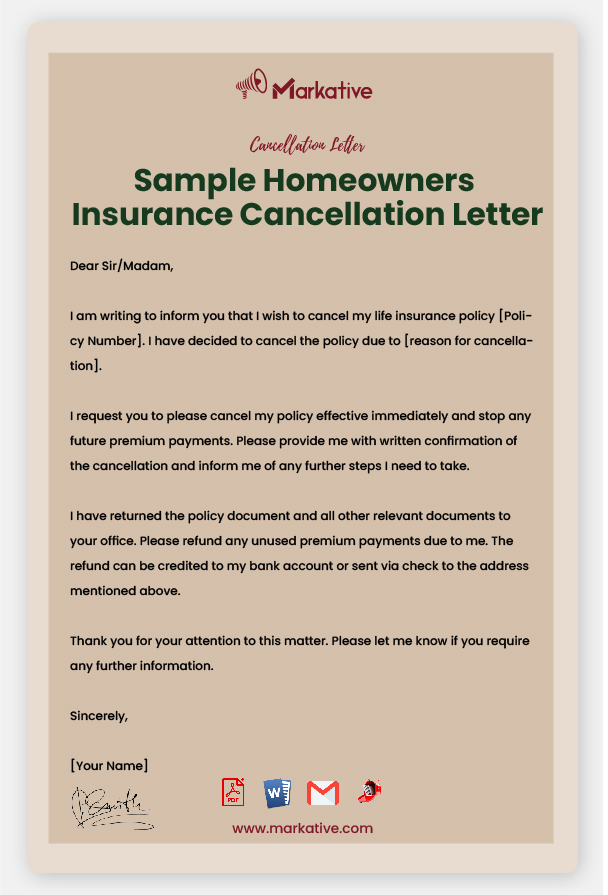

Sample Homeowners Insurance Cancellation Letter

Dear [Insurance Company], I am writing to inform you that I would like to cancel my homeowners insurance policy with your company, effective [date]. My policy number is [policy number]. The reason for my cancellation is that I have recently sold my home and will no longer be needing this insurance coverage. I appreciate the services that your company has provided me over the years, but it is time for me to move on. Please let me know what steps I need to take to ensure that the cancellation process goes smoothly. If there are any forms that I need to fill out or any other information that I need to provide, please let me know as soon as possible. Thank you for your attention to this matter. I look forward to hearing from you soon. Sincerely, [Your Name]

For More: Best Insurance Cancellation Letter [7+ Templates]

Homeowners Insurance Cancellation Letter Template

Dear [Insurance Company], I am writing this letter to request the cancellation of my homeowners insurance policy. My policy number is [insert policy number], and the effective date of the policy is [insert effective date]. I have decided to cancel the policy because [insert reason for cancellation]. Please confirm the cancellation in writing and let me know the effective date of cancellation. I request that any remaining premium be refunded to me, and I am aware that any refund will be prorated based on the cancellation date. Please let me know the amount of the refund and how it will be issued. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

For More: Best Health Insurance Cancellation Letter [5+ Templates]

Effective Homeowners Insurance Cancellation Letter

Dear [Insurance Company], I am writing to inform you that I would like to cancel my homeowners insurance policy with your company effective [date of cancellation]. The policy number is [policy number]. I have found a better insurance option that suits my needs and budget, and I would like to discontinue my coverage with your company. Please let me know the steps I need to take to complete the cancellation process. If there are any cancellation fees or other requirements, please let me know as well. Thank you for your attention to this matter. Sincerely, [Your Name]

When Should You Cancel a Homeowners Insurance Cancellation Letter

Homeowners insurance is an essential protection for your home and assets. However, there may be instances where you need to cancel your policy, such as selling your home or finding a better insurance deal. If you’ve already sent a cancellation letter to your insurance company, you should consider canceling it if you change your mind or decide to keep your policy.

For example, if you cancel your policy but then experience a significant loss, such as a fire or flood, you’ll have to pay out of pocket for repairs or replacements. It’s crucial to carefully review your insurance needs and coverage before canceling your policy and to consult with your insurance agent before sending any cancellation letter.

Reasons to consider canceling your Homeowners Insurance Cancellation Letter

Canceling your homeowners insurance can be a risky move, as it leaves your home and belongings vulnerable to unforeseen events such as natural disasters and theft. Furthermore, it may make it difficult to get a new policy in the future or result in higher premiums. Therefore, carefully weigh the benefits and risks before canceling your homeowners insurance.

Conclusion:

Writing a homeowners insurance cancellation letter is a necessary task that homeowners may need to undertake for various reasons. When writing a cancellation letter, it is important to ensure that it is clear, concise, and includes all relevant information such as policy details and reasons for cancellation. Additionally, homeowners should take care to avoid common mistakes such as providing incomplete information or failing to send the letter to the correct address.

To make the process easier, we have provided multiple free and ready-to-use templates that homeowners can use to draft their cancellation letter. These templates include options for various scenarios such as selling a home, switching insurance providers, or simply wanting to cancel the policy. By following these guidelines and utilizing the provided templates, homeowners can ensure that their cancellation letter is well-written and effective.

Finally, it is important to note that homeowners should send their cancellation letter to the correct address and ensure that they receive confirmation of its receipt. This will ensure that their policy is properly cancelled and that they are not charged any unnecessary fees. Overall, writing a homeowners insurance cancellation letter can be a simple process when done correctly, and can help homeowners make informed decisions about their insurance coverage.