Insurance is a vital aspect of our lives as it provides us with a sense of security and financial protection. However, there are times when an individual or business may need to cancel their insurance policy. In such cases, it is important to provide a well-written and professional insurance cancellation letter. A cancellation letter is a formal document that is sent to the insurance company, notifying them of the intent to terminate the policy. A professional and appealing cancellation letter not only ensures that the policy is canceled but also helps maintain a good relationship between the policyholder and the insurance company.

The impact of a good complaint letter cannot be underestimated. It can bring attention to an issue and prompt a quick resolution. Similarly, a well-written cancellation letter can also have a significant impact on the insurance company. A clear and concise letter, detailing the reasons for the cancellation, can help the insurance company improve their policies and services. It also gives the policyholder an opportunity to express their concerns and feedback, which can be valuable to the insurance company.

In this article, we will explore why it is essential to write a professional and appealing insurance cancellation letter. We will discuss the importance of effective communication, as well as the benefits of providing feedback to the insurance company. By the end of this article, readers will have a better understanding of how to write a cancellation letter that is not only clear and concise but also creates a positive impact.

How To Write Insurance Cancellation Letter?

Writing a well-crafted insurance cancellation letter is important to ensure that the process is completed smoothly and without any confusion. In this article, we will discuss five steps on how to write the best insurance cancellation letter that creates an impact.

5 Steps on How To Write Best Insurance Cancellation Letter:

- Start with a clear and concise statement of cancellation.

- Include the policy details, such as the policy number, start and end dates.

- Explain the reason for cancellation in a polite and professional tone.

- Request a confirmation of the cancellation and any applicable refunds.

- Close the letter with a polite and appreciative statement.

Example:

Dear Insurance Provider, I am writing this letter to request the cancellation of my policy with policy number 123456, which started on January 1, 2023, and is set to end on December 31, 2023. The reason for my cancellation is due to a change in my financial circumstances. I would appreciate if you could confirm the cancellation and provide any applicable refunds as soon as possible. I would like to thank you for your services during the time that I was your client. Sincerely, [Your Name]

Conclusion: Writing an effective insurance cancellation letter can help ensure a smooth and hassle-free process. By following the steps outlined above, you can craft a letter that clearly communicates your intent and creates a positive impact. Remember to be polite and professional throughout the process to maintain a good relationship with your insurance provider.

Insurance Cancellation Letter Format

Sure, below is an example of an insurance cancellation letters format in table form:

| [Your Name] | [Your Address] | [City, State ZIP Code] |

|---|---|---|

| [Date] | ||

| [Insurance Company] | [Address] | [City, State ZIP Code] |

| Re: Cancellation of Insurance Policy |

Dear [Insurance Company],

I am writing this letters to request the cancellation of my insurance policy. The details of my policy are as follows:

| Policy Number: | [Insert Policy Number] |

|---|---|

| Policyholder Name: | [Insert Policyholder Name] |

| Policy Start Date: | [Insert Policy Start Date] |

| Policy End Date: | [Insert Policy End Date] |

I would like to request the cancellation of this policy effective [Insert Cancellation Date], which is [Insert Number of Days] days from the date of this letter. Please let me know if any additional information is needed.

Please also confirm in writing that the policy has been cancelled and the effective date of cancellation.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature] [Your Name]For More: Best Health Insurance Cancellation Letters [5+ Templates]

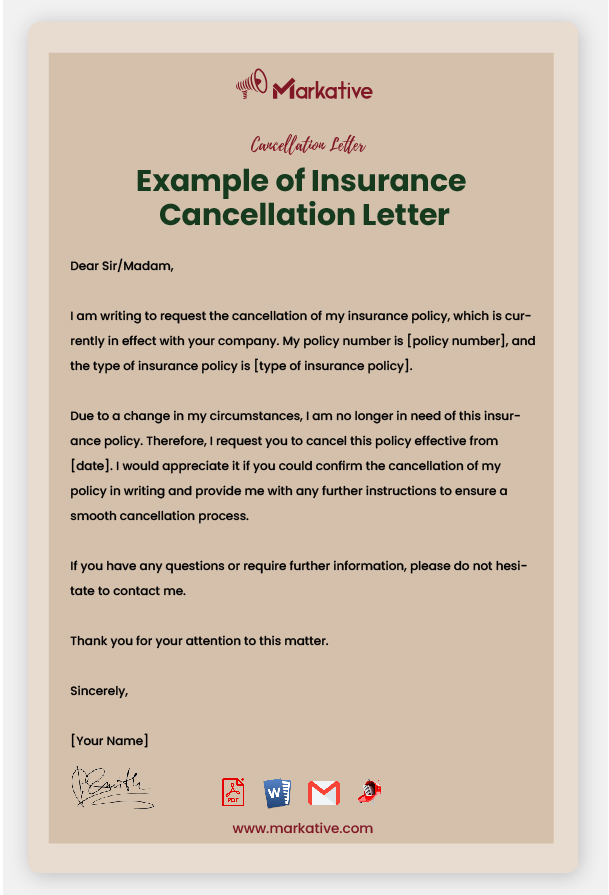

Example of Insurance Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Insurance Company Name] [Address] [City, State ZIP Code] Subject: Cancellation of Insurance Policy Dear Sir/Madam, I am writing to request the cancellation of my insurance policy, which is currently in effect with your company. My policy number is [policy number], and the type of insurance policy is [type of insurance policy]. Due to a change in my circumstances, I am no longer in need of this insurance policy. Therefore, I request you to cancel this policy effective from [date]. I would appreciate it if you could confirm the cancellation of my policy in writing and provide me with any further instructions to ensure a smooth cancellation process. I would like to thank you for the services you have provided to me in the past, and I hope to do business with you in the future. If you have any questions or require further information, please do not hesitate to contact me. Thank you for your attention to this matter. Sincerely, [Your Name]

For More: Great Complaint Letter to Insurance Company For Claim [5+ Templates]

Sample Insurance Cancellation Letter

Dear [Insurance Company Name], I am writing to request the cancellation of my insurance policy effective [date]. My policy number is [policy number]. Unfortunately, due to unforeseen circumstances, I am no longer able to continue with this insurance policy. I have decided to pursue another insurance provider, and I kindly ask that you cancel my policy as soon as possible. Please inform me of any steps I need to take to complete the cancellation process. Also, I would appreciate it if you could confirm the cancellation in writing and provide any necessary refund or prorated amount owed to me. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

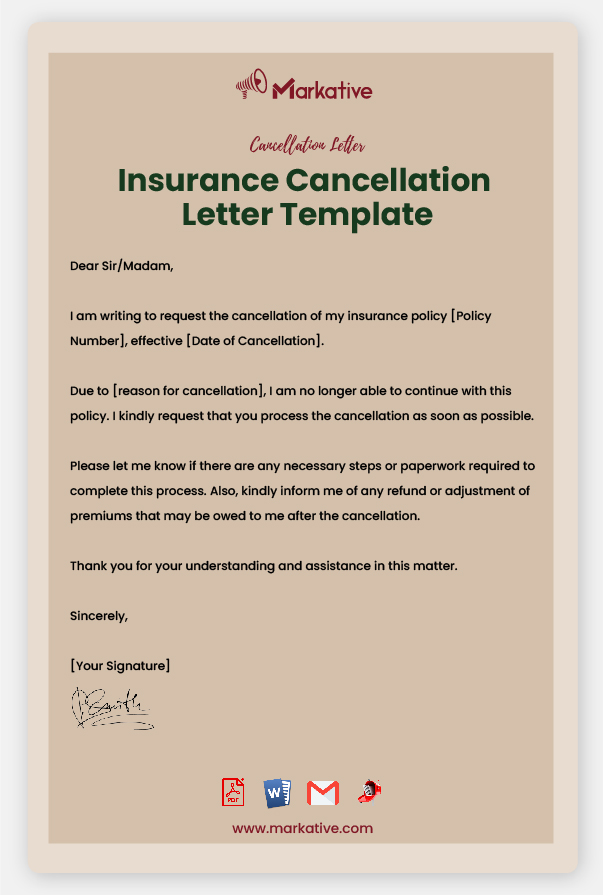

Insurance Cancellation Letter Template

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Insurance Company Name] [Address] [City, State ZIP Code] Dear Sir/Madam, I am writing to request the cancellation of my insurance policy [Policy Number], effective [Date of Cancellation]. Due to [reason for cancellation], I am no longer able to continue with this policy. I kindly request that you process the cancellation as soon as possible. Please let me know if there are any necessary steps or paperwork required to complete this process. Also, kindly inform me of any refund or adjustment of premiums that may be owed to me after the cancellation. Thank you for your understanding and assistance in this matter. Sincerely, [Your Signature] [Your Printed Name]

For More: Best Complaint Letter to Insurance Company for Claim Rejection [5+ Templates]

Effective Insurance Cancellation Letter

Dear [Insurance Provider], I am writing to inform you of my intention to cancel my insurance policy effective [date of cancellation]. Unfortunately, due to recent changes in my financial situation, I can no longer afford the premium payments associated with my policy. While I have been satisfied with the coverage and service provided by your company, I must make this difficult decision in order to prioritize my financial responsibilities. Please consider this letter as my official notice of cancellation. I would appreciate confirmation in writing that my policy will be cancelled and that no further payments will be deducted from my account after the date of cancellation. Thank you for your understanding in this matter. Sincerely, [Your Name]

When Should You Cancel a Insurance Cancellation Letters

You should cancel an insurance policy if you no longer require the coverage, have found a better deal elsewhere, or if the insurer has breached their contract. However, it’s important to review the policy terms and conditions before sending a cancellation letter.

For example, if you cancel a car insurance policy mid-term, you may still owe a prorated amount for the coverage that you’ve already used. Additionally, if you cancel a life insurance policy, you may lose some of the benefits that you’ve accrued over time. It’s important to carefully consider your options and consult with an insurance professional before sending a cancellation letters.

Reasons to consider canceling your Insurance Cancellation Letters

There may be several reasons to consider canceling your insurance policy. It could be due to financial constraints, a change in life circumstances, or finding a better policy elsewhere. However, before canceling, it’s important to weigh the potential risks and benefits, and to ensure that you have adequate coverage in place. Ultimately, the decision to cancel your insurance should be made with careful consideration and in consultation with your insurance provider.

Conclusion:

Writing an insurance cancellation letters is an important process that should be handled with care. It is essential to understand when and where to send the letter, as well as the common mistakes to avoid. When writing a cancellation letter, ensure that you are clear and concise, provide all necessary details, and be polite and professional in your tone.

Sending the letter via certified mail with return receipt requested is a recommended method to ensure it is received by the insurer. It is also important to follow up with a phone call to confirm that the cancellation request was received and processed.

To make the process easier, we have provided multiple free and ready-to-use templates that you can use to draft your cancellation letter. Remember to customize the letter to your specific situation and insurer. With these tips and templates, you can confidently cancel your insurance policy and move forward with your insurance needs.