In today’s world, where the economy is unstable, and the financial industry is unpredictable, borrowing money has become a common practice for individuals and businesses alike. However, at times, circumstances arise where you may no longer require the funds, or the loan does not suit your needs. In such situations, a bank loan cancellation letter becomes a crucial document. It is essential to write a professional and appealing cancellation letter to ensure a smooth process and maintain a healthy relationship with the lender.

A good complaint letter can create a significant impact on the concerned authorities. A cancellation letter is a type of complaint letter, and it can create a positive or negative impact depending on how well it is written. A well-drafted letter can help you convey your message efficiently, avoiding any confusion or misunderstandings. It can also help you avoid any future disputes or legal complications that may arise due to miscommunication.

In this article, we will discuss the importance of a professional and appealing bank loan cancellation letter. We will explore the necessary elements that must be included in the letter, the language that should be used, and the tone that must be maintained. Furthermore, we will provide you with some useful tips to help you write an effective and impactful letter. Whether you are an individual borrower or a business owner, this article is a must-read for anyone who wants to cancel their loan with ease and professionalism.

How To Write Bank Loan Cancellation Letter?

When it comes to canceling a bank loan, it’s essential to write a well-crafted letter to create a good impression. Here are five steps to help you write the best bank loan cancellation letter that will make a strong impact.

Steps to Write the Best Bank Loan Cancellation Letter:

- Begin with a formal salutation and state the purpose of the letter clearly.

Example: Dear [Bank Manager’s Name], I am writing this letter to request the cancellation of my loan account [Loan Account Number].

- Mention the reason why you want to cancel the loan and provide relevant details.

Example: Due to unforeseen circumstances, I have decided to cancel the loan. I have attached all the necessary documents, including the loan agreement, payment receipts, and a copy of my ID card for verification purposes.

- Request the bank to cancel the loan and specify the date by which you want the cancellation to be effective.

Example: I request you to cancel my loan account with immediate effect, and I would appreciate it if you could confirm the cancellation by email or post within the next ten business days.

- Express your gratitude for the bank’s services and state that you are willing to settle any outstanding balances.

Example: I want to express my gratitude for the services that your bank has provided me during my loan tenure. I am willing to settle any outstanding balances and make the necessary arrangements to ensure a smooth cancellation process.

- Close the letter with a formal sign-off and your contact details.

Example: Thank you for your assistance in this matter. If you require any further information or clarification, please do not hesitate to contact me at [Your Contact Details]. Sincerely, [Your Name].

Conclusion: By following these five simple steps, you can write a well-structured and impactful bank loan cancellation letter that will create a positive impression with the bank. Remember to keep your tone polite and professional throughout the letter, and provide all the necessary details to facilitate a smooth cancellation process.

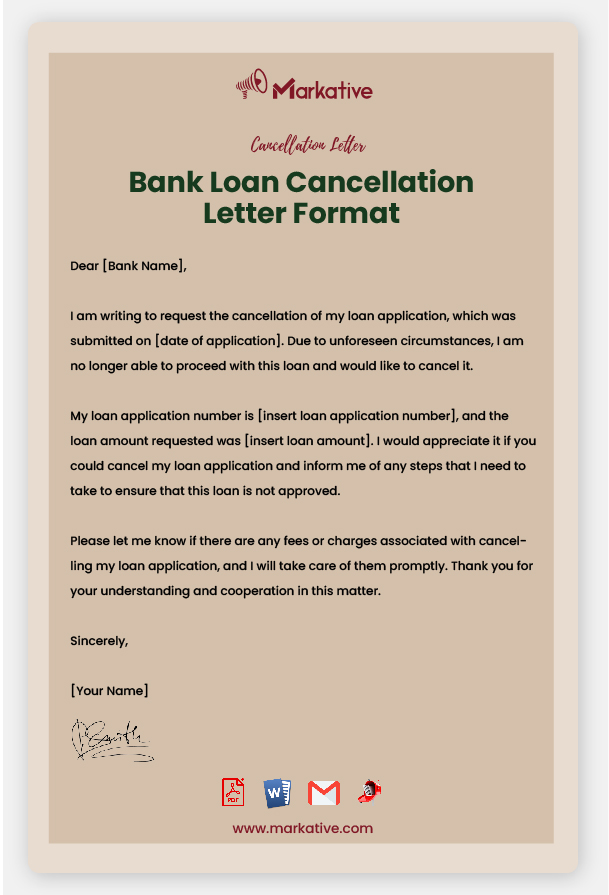

Bank Loan Cancellation Letter Format

Dear [Bank Name], I am writing to request the cancellation of my loan application, which was submitted on [date of application]. Due to unforeseen circumstances, I am no longer able to proceed with this loan and would like to cancel it. My loan application number is [insert loan application number], and the loan amount requested was [insert loan amount]. I would appreciate it if you could cancel my loan application and inform me of any steps that I need to take to ensure that this loan is not approved. Please let me know if there are any fees or charges associated with cancelling my loan application, and I will take care of them promptly. Thank you for your understanding and cooperation in this matter. Sincerely, [Your Name]

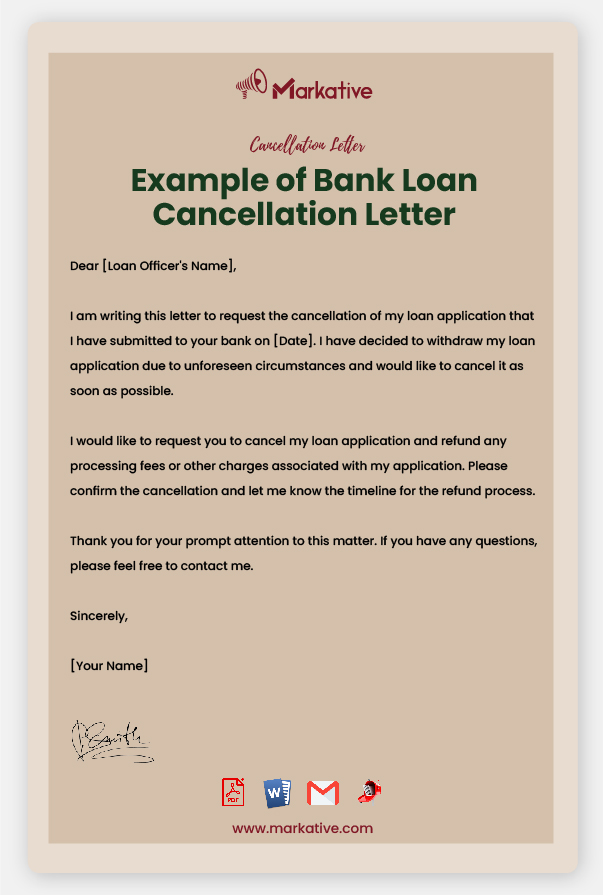

Example of Bank Loan Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Loan Officer's Name] [Bank Name] [Bank Address] [City, State ZIP Code] Dear [Loan Officer's Name], I am writing this letter to request the cancellation of my loan application that I have submitted to your bank on [Date]. I have decided to withdraw my loan application due to unforeseen circumstances and would like to cancel it as soon as possible. My loan application details are as follows: Loan Application Number: [Loan Application Number] Loan Amount: [Loan Amount] Loan Type: [Loan Type] I would like to request you to cancel my loan application and refund any processing fees or other charges associated with my application. Please confirm the cancellation and let me know the timeline for the refund process. Thank you for your prompt attention to this matter. If you have any questions, please feel free to contact me. Sincerely, [Your Name]

For More: Best Complaint Letter Against Bank Charges [5 Free Samples]

Sample Bank Loan Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Loan Company Name] [Loan Company Address] [City, State ZIP Code] Dear Sir/Madam, I am writing this letter to inform you that I wish to cancel the loan that I had applied for from your esteemed institution. My loan application reference number is [Loan Application Reference Number]. After considering my financial situation, I have decided that it would be in my best interest to cancel the loan application. Therefore, I kindly request you to cancel the loan application and any related documentation. I apologize for any inconvenience this may cause and I hope that this matter can be resolved promptly. Please let me know if there are any additional steps that I need to take in order to complete the cancellation process. Thank you for your understanding and cooperation. Sincerely, [Your Name]

Bank Loan Cancellation Letter Template

Dear [Bank Name], I am writing to formally request the cancellation of my loan account with your institution. The loan account number is [insert account number]. Due to unforeseen circumstances, I am unable to continue with the loan repayments. After careful consideration of my financial situation, I have decided to cancel the loan account. I understand that this decision may impact my credit rating, but I have no other option at this time. I would like to request a confirmation letter stating that the loan account has been cancelled and that no further payments are required. Additionally, I request that you waive any prepayment penalties or fees associated with this cancellation. Please let me know if any further information is required from me to process this request. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

For More: Best Fraud Transaction Complaint Letter to Bank [5+ Templates]

Effective Bank Loan Cancellation Letter

Dear [Bank Name], I am writing to request the cancellation of my loan with account number [Loan Account Number]. Due to unforeseen circumstances, I am no longer able to continue making payments on this loan. I understand that there may be penalties or fees associated with canceling the loan, and I am willing to accept these charges. Please provide me with a breakdown of any outstanding balance and fees that may be owed. I would appreciate your prompt attention to this matter, as I am currently experiencing financial difficulties and need to take action to manage my finances responsibly. Thank you for your assistance in this matter. If you require any further information or documentation, please do not hesitate to contact me. Sincerely, [Your Name]

When Should You Cancel a Bank Loan Cancellation Letter

A bank loan cancellation letter should be sent when a borrower wants to cancel or terminate their existing loan agreement with the bank. However, there may be situations where cancelling a loan may not be the best option. For example, if a borrower has already received the loan amount and used it for their intended purpose, cancelling the loan may not be feasible or advantageous.

Similarly, if a borrower has already made a significant number of payments towards the loan, cancelling it may not make financial sense as it could result in additional fees or penalties. Ultimately, the decision to cancel a bank loan should be carefully evaluated based on the individual circumstances and financial goals of the borrower.

Reasons to consider canceling your Bank Loan Cancellation Letter

Canceling your bank loan can be a difficult decision, but it may be necessary in certain circumstances.

- Firstly, if you’re struggling to make payments due to a change in financial situation.

- Secondly, if you’ve found a better loan offer with more favorable terms.

- Thirdly, if you’re able to pay off the loan in full without any penalty fees.

Ultimately, carefully considering the pros and cons of canceling your bank loan is essential to making the best decision for your financial situation.

Conclusion:

Canceling a bank loan can be a daunting task, but with the right approach, it can be made easier. When writing a bank loan cancellation letters, it is crucial to include all the necessary information and follow the bank’s guidelines for cancellation. It is important to send the letter to the correct address and through the appropriate channels. Common mistakes to avoid include using inappropriate language, not providing enough details, and not including your contact information.

To make the process easier, we have provided multiple free and ready-to-use templates that you can use. These templates can be customized to suit your specific needs and can be downloaded for free. With these templates, you can save time and avoid the stress of drafting a letter from scratch.

Remember, canceling a bank loan requires careful consideration and attention to detail. By following the tips and guidelines provided, you can ensure that your cancellation letters is effective and efficient, ultimately leading to the successful cancellation of your bank loan.