Buying a home is one of the most significant financial decisions a person makes in their lifetime. It involves a lot of planning, research, and financing. One of the most common financing options is a home loan, which allows a person to purchase a home by borrowing money from a lender. However, sometimes circumstances change, and the borrower may need to cancel their home loan. In such situations, it is important to write a professional and appealing home loan cancellation letter. This article explores the importance of a well-written home loan cancellation letter and how it can affect the borrower’s financial and legal standing.

Writing a professional and appealing home loan cancellation letter is crucial in several ways. Firstly, it creates a good impression on the lender and showcases the borrower’s professionalism and respect for the lender. Secondly, a well-crafted letter can help the borrower avoid legal and financial consequences. If the letter is not written appropriately, the lender may hold the borrower responsible for any outstanding balances or penalties. Thirdly, a good home loan cancellation letter can save the borrower time and money. A well-written letter can expedite the cancellation process and reduce the chances of any additional fees or charges.

In this article, we will discuss the importance of a well-written home loan cancellation letter and how it can affect the borrower’s financial and legal standing. We will also explore the impact of a good complaint letter on the lender and their practices. Lastly, we will provide tips and guidelines on how to write a professional and appealing home loan cancellation letter that can help borrowers avoid legal and financial consequences.

How To Write Home Loan Cancellation Letter?

Writing a well-crafted home loan cancellation letter is important if you have decided to terminate your mortgage agreement. This type of letter is essential to communicate your intent to cancel and ensure a smooth transition.

Here are the 5 steps on How To Write Best Home Loan Cancellation Letter that create impact:

- Start with a clear statement: Begin your letter with a concise and direct statement indicating that you wish to cancel your home loan. This ensures there is no ambiguity in your message and sets the tone for the rest of the letter.

- Provide relevant information: In the next section, provide the necessary information such as your name, loan account number, and other pertinent details. This will help the lender quickly identify your account and process your request smoothly.

- State reasons for cancellation: It is important to state your reasons for cancelling the loan. Be honest and straightforward in your approach. This will help the lender understand your situation better and improve their services in the future.

- Provide necessary documents: Ensure that you attach all the necessary documents such as your ID proof, loan agreement, and other relevant paperwork with your letter. This will facilitate a quick and hassle-free cancellation process.

- End on a positive note: Conclude your letter on a positive note by thanking the lender for their services and expressing your willingness to cooperate with them during the cancellation process.

Conclusion: Writing a home loan cancellation letters can seem daunting, but with the right approach and attention to detail, it can be a simple and effective process. By following the above steps and examples, you can create a well-crafted letter that communicates your intent clearly and concisely, and ensures a smooth transition.

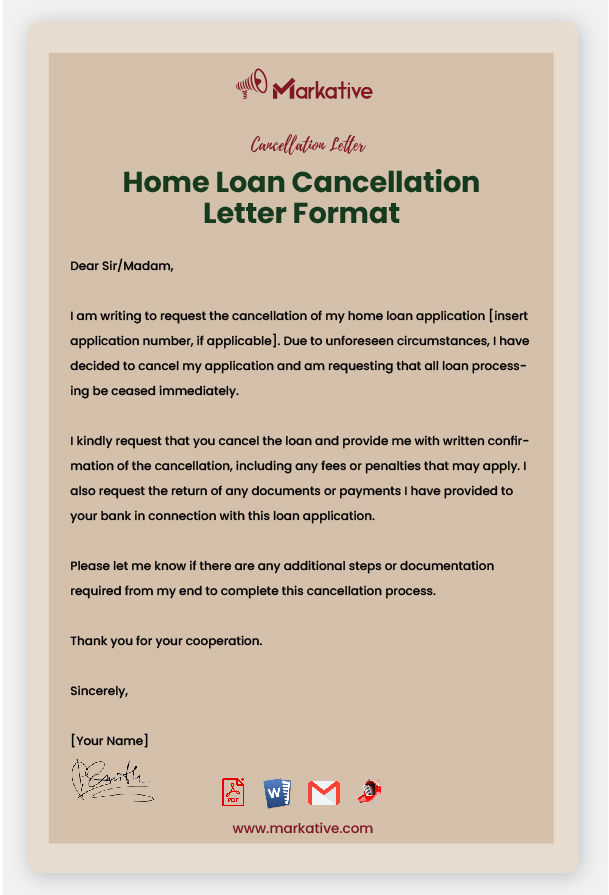

Home Loan Cancellation Letter Format

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Name of Loan Officer] [Bank Name] [Address] [City, State ZIP Code] Subject: Home Loan Cancellation Request Dear Sir/Madam, I am writing to request the cancellation of my home loan application [insert application number, if applicable]. Due to unforeseen circumstances, I have decided to cancel my application and am requesting that all loan processing be ceased immediately. I kindly request that you cancel the loan and provide me with written confirmation of the cancellation, including any fees or penalties that may apply. I also request the return of any documents or payments I have provided to your bank in connection with this loan application. I understand that there may be fees or penalties associated with the cancellation of the loan, and I am prepared to pay any such fees as required. Please let me know if there are any additional steps or documentation required from my end to complete this cancellation process. Thank you for your cooperation. Sincerely, [Your Name]

For More: Best Bank Loan Cancellation Letter [5+ Templates]

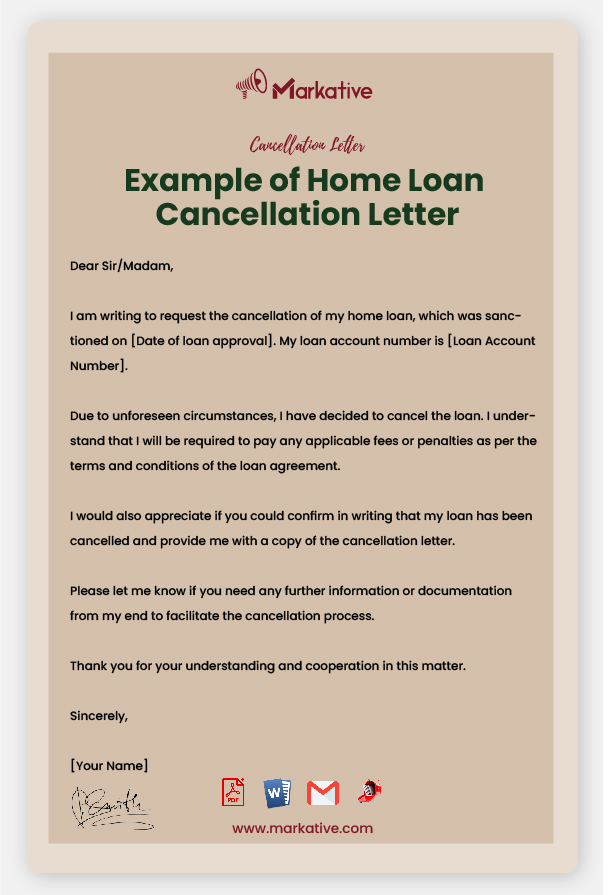

Example of Home Loan Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Loan Provider's Name] [Address] [City, State ZIP Code] Dear Sir/Madam, I am writing to request the cancellation of my home loan, which was sanctioned on [Date of loan approval]. My loan account number is [Loan Account Number]. Due to unforeseen circumstances, I have decided to cancel the loan. I understand that I will be required to pay any applicable fees or penalties as per the terms and conditions of the loan agreement. I request you to provide me with a detailed breakup of any fees or charges that I may be liable to pay and the steps I need to take to complete the cancellation process. I would also appreciate if you could confirm in writing that my loan has been cancelled and provide me with a copy of the cancellation letter. Please let me know if you need any further information or documentation from my end to facilitate the cancellation process. Thank you for your understanding and cooperation in this matter. Sincerely, [Your Name]

Home Loan Cancellation Letter Sample

Dear Sir/Madam, I am writing this letter to request the cancellation of my home loan with [Loan Servicing Company Name], which was initiated on [Loan Initiation Date]. Due to unforeseen circumstances, I am no longer able to continue with the loan. I would appreciate it if you could process the cancellation of my loan as soon as possible and provide me with the necessary documentation confirming the cancellation. Please let me know if there are any outstanding payments or charges that need to be settled before the cancellation can be processed. I appreciate your assistance in this matter and thank you for your time. Sincerely, [Your Name]

For More: Best Cheque Cancellation Letter [5+ Templates]

Home Loan Cancellation Letter Template

Dear [Lender's Name], I am writing this letter to formally request the cancellation of my home loan application with your institution. My loan application number is [Loan Application Number]. I have reconsidered my financial situation and have decided not to move forward with this loan. Therefore, I would like to cancel my application with immediate effect. I request you to please confirm the cancellation of my loan application and provide me with a written acknowledgement of the same. I would appreciate it if you could provide any further instructions on how to close this account. Thank you for your understanding and assistance in this matter. Sincerely, [Your Name]

Effective Home Loan Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Bank Name] [Bank Address] [City, State ZIP Code] Dear Sir/Madam, I am writing this letter to request the cancellation of my home loan with your bank. The details of my home loan are as follows: Loan account number: [Insert Loan Account Number] Loan amount: [Insert Loan Amount] Date of loan disbursement: [Insert Date of Loan Disbursement] I have decided to cancel my home loan due to [Insert Reason for Cancellation]. I have fulfilled all the necessary requirements and cleared all the dues related to the loan account. Therefore, I request you to initiate the cancellation process at the earliest and provide me with the necessary documents related to the same. Please inform me of any other formalities that need to be completed from my end to ensure a smooth and hassle-free cancellation process. Also, kindly provide me with a confirmation letter acknowledging the receipt of this cancellation letter. Thank you for your assistance in this matter. Sincerely, [Your Name]

When Should You Cancel a Home Loan Cancellation Letters

A home loan cancellation letters should be canceled when the borrower decides not to cancel the loan after all. This may happen if the borrower changes their mind about refinancing or decides to go with a different lender. For example, suppose a borrower receives a home loan cancellation letters from their current lender and starts the cancellation process.

However, after exploring other options, the borrower realizes that the terms of their current loan are more favorable than those offered by other lenders. In that case, the borrower should cancel the cancellation letter and continue with their current loan.

Reasons to consider canceling your Home Loan Cancellation Letters

There are a few reasons why you might consider canceling your home loan, such as if you have found a better loan offer or if your financial situation has changed. However, before canceling, make sure to consider any fees or penalties involved and weigh the benefits and drawbacks carefully.

In conclusion, canceling a home loan can have both positive and negative consequences, so it’s important to evaluate your individual circumstances and make an informed decision based on your financial goals and priorities.

Conclusion:

Writing a home loan cancellation letters can seem like a daunting task, but with the right approach, it can be a simple and straightforward process. When writing the letter, it’s important to include all necessary information, such as the loan account number and the reason for cancellation. Additionally, the letter should be sent to the appropriate parties, such as the lender and any co-borrowers or guarantors.

To avoid common mistakes when writing a cancellation letter, be sure to proofread and double-check all information before sending. It’s also helpful to follow a template or sample letter to ensure that all necessary information is included.

There are many free and ready-to-use templates available online for home loan cancellation letters, including those provided by banks and financial institutions. Some templates that we recommend include those offered by Rocket Lawyer, Template.net, and Docformats.

Overall, writing a home loan cancellation letters is an important step in ending your loan agreement and should be done carefully and thoughtfully. By following the guidelines and using the templates provided, you can ensure that your letter is effective and professional.