Bank guarantee cancellation letter are an essential part of the banking process. They are formal letters that notify the bank of the termination of a bank guarantee agreement between the bank and the customer. A well-written bank guarantee cancellation letter can help ensure a smooth and hassle-free cancellation process. It is crucial to write a professional and appealing letter to the bank. When requesting a cancellation to maintain a positive business relationship with the bank.

A professional and appealing cancellation letter is important because it not only conveys the message of cancellation but also reflects the writer’s professionalism and communication skills. A poorly written letter can give the impression of unprofessionalism, which can lead to delays in the cancellation process or damage to the business relationship with the bank. A well-written letter, on the other hand, can create a positive impression and make the process smoother and quicker. It can also help to establish a good rapport with the bank, which is crucial for future business dealings.

In addition, a good complaint letter creates an impact. It is essential to communicate any dissatisfaction or issues with the bank’s services clearly and professionally. A well-written complaint letter can provide valuable feedback to the bank and help them to improve their services.

It can also help to resolve any disputes or issues with the bank, avoiding legal action or financial losses. Therefore, it is important to understand the importance of writing a professional and appealing bank guarantee cancellation letter. In this article, we will discuss the key elements of a good cancellation letter. The dos and don’ts of writing it, and how to ensure that the letter has the desired impact.

How To Write Bank Guarantee Cancellation Letter?

If you need to write a bank guarantee cancellation letter, it’s important to make sure it’s done correctly to avoid any issues or misunderstandings. In this guide, we’ll provide you with five steps to help you write the best bank guarantee cancellation letter possible, along with examples to illustrate each step.

Five Steps on How To Write Best Bank Guarantee Cancellation Letter:

- Address the letter properly: Start by addressing the letter to the appropriate person or department at the bank. Include your account information and the date of the guarantee.

- Explain the reason for cancellation: Clearly state why you need to cancel the bank guarantee. Be specific and provide any relevant details that may help the bank understand your request.

- Provide any necessary documentation: If there are any documents or forms that need to be filled out or submitted to cancel the guarantee, include them with the letter.

- Request confirmation of cancellation: Ask the bank to confirm in writing that the guarantee has been cancelled. This will help to avoid any confusion or disputes in the future.

Conclusion: By following these five steps and using the examples provided, you can write a clear and effective bank guarantee cancellation letters that will help ensure that your request is processed quickly and accurately.

Bank Guarantee Cancellation Letter Format

| Date: [Insert Date] |

|---|

| [Insert Name of Bank] | | [Insert Address of Bank] | | [Insert City, State and Zip Code] | | [Insert Country] |

Dear Sir/Madam,

We hereby request for the cancellation of the following bank guarantee:

| Guarantee Number: | [Insert Guarantee Number] |

|---|---|

| Amount: | [Insert Amount] |

| Date of Issuance: | [Insert Date of Issuance] |

| Expiry Date: | [Insert Expiry Date] |

We confirm that there are no outstanding payments or obligations related to the above mentioned bank guarantee. Therefore, we request you to cancel the bank guarantee with immediate effect and release the collateral, if any, held against it.

We also confirm that we shall not hold the bank responsible for any losses or damages arising from the cancellation of the bank guarantee.

Please acknowledge receipt of this letter and confirm the cancellation of the bank guarantee.

Thank you for your cooperation.

Yours faithfully,

[Insert Your Name] [Insert Your Designation] [Insert Your Company Name]Example of Bank Guarantee Cancellation Letter

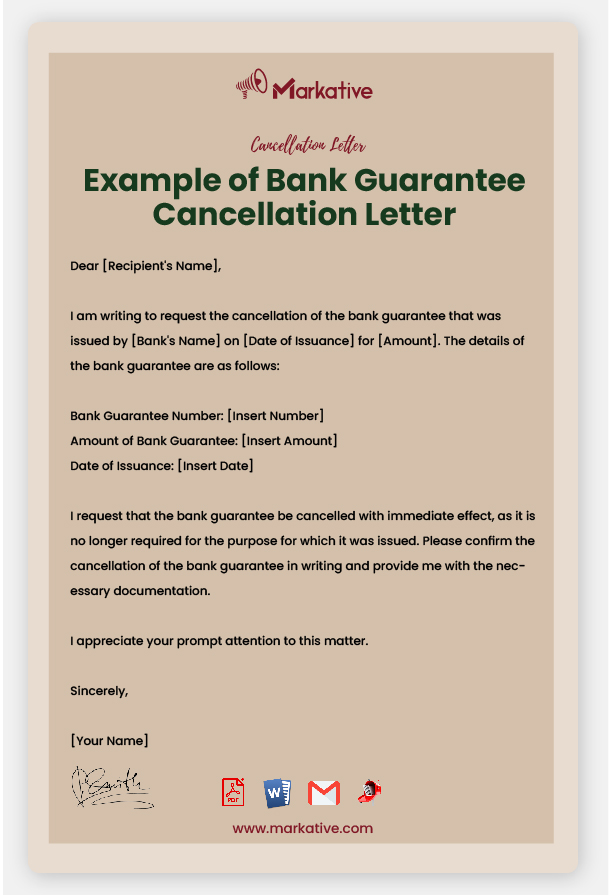

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Recipient's Name] [Recipient's Address] [City, State ZIP Code] Dear [Recipient's Name], I am writing to request the cancellation of the bank guarantee that was issued by [Bank's Name] on [Date of Issuance] for [Amount]. The details of the bank guarantee are as follows: Bank Guarantee Number: [Insert Number] Amount of Bank Guarantee: [Insert Amount] Date of Issuance: [Insert Date] I request that the bank guarantee be cancelled with immediate effect, as it is no longer required for the purpose for which it was issued. Please confirm the cancellation of the bank guarantee in writing and provide me with the necessary documentation. If there are any fees or charges associated with the cancellation of the bank guarantee, please let me know in advance so that I can arrange for payment. I appreciate your prompt attention to this matter. Sincerely, [Your Name]

For More: Best Bank Loan Cancellation Letter [5+ Templates]

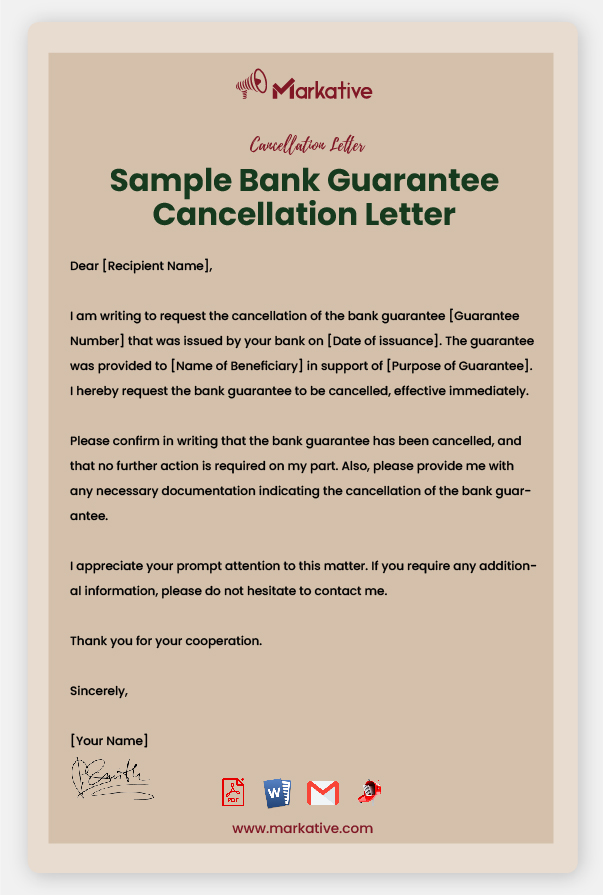

Sample Bank Guarantee Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Recipient Name] [Recipient Address] [City, State ZIP Code] Subject: Cancellation of Bank Guarantee [Guarantee Number] Dear [Recipient Name], I am writing to request the cancellation of the bank guarantee [Guarantee Number] that was issued by your bank on [Date of issuance]. The guarantee was provided to [Name of Beneficiary] in support of [Purpose of Guarantee]. I hereby request the bank guarantee to be cancelled, effective immediately. Please confirm in writing that the bank guarantee has been cancelled, and that no further action is required on my part. Also, please provide me with any necessary documentation indicating the cancellation of the bank guarantee. I appreciate your prompt attention to this matter. If you require any additional information, please do not hesitate to contact me. Thank you for your cooperation. Sincerely, [Your Name]

For More: Best Complaint Letter Against Bank Charges [5 Free Samples]

Bank Guarantee Cancellation Letter Template

[Your Company Letterhead or Your Name and Address] [Date] [Recipient Name] [Recipient Address] Subject: Bank Guarantee Cancellation Letter Dear [Recipient Name], I am writing to request the cancellation of Bank Guarantee Number [Insert Guarantee Number] issued by [Insert Bank Name] on [Insert Issue Date]. We would like to inform you that our company no longer requires this Bank Guarantee. As per the terms and conditions mentioned in the agreement, we request you to kindly cancel the said Bank Guarantee at your earliest convenience. Please find attached a copy of the Bank Guarantee for your reference. We would appreciate your prompt attention to this matter. Thank you for your cooperation. Sincerely, [Your Name and Signature]

For More: Attractive Complaint Letter to Bank for Unauthorised Transactions [5+ Free Samples]

Effective Bank Guarantee Cancellation Letter

Dear [Bank], I am writing to request the cancellation of the bank guarantee referenced [insert reference number]. The reason for this cancellation is [insert reason for cancellation]. Please take note that all obligations and liabilities under the guarantee have been fulfilled, and there are no outstanding claims or disputes related to the guarantee. I kindly request that you confirm in writing the cancellation of the bank guarantee as soon as possible and provide me with a copy of the cancellation notice. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

When Should You Cancel a Bank Guarantee Cancellation Letters

A bank guarantee is a legal document issued by a bank to ensure payment in case of default by a borrower. If the terms of the agreement between the borrower and the beneficiary are fulfilled, the bank guarantee can be canceled. However, a bank guarantee cancellation letters should only be canceled if all the obligations have been met, and the beneficiary has received the payment or fulfilled the terms of the agreement.

For example, if a construction company has completed a project and all the payments have been made, the bank guarantee can be canceled, and the cancellation letters can be issued to the bank. On the other hand, if the borrower has not fulfilled the terms of the agreement, the beneficiary may not cancel the bank guarantee, and the bank may pay the beneficiary according to the guarantee terms. Therefore, canceling a bank guarantee cancellation letters should only be done when all the obligations have been met, and it is no longer needed for the transaction.

Reasons to consider canceling your Bank Guarantee Cancellation Letter

There are several reasons why one may consider canceling a bank guarantee, such as the completion of the project, reduced risk factors, or a change in business circumstances. However, it is essential to carefully review the terms and conditions of the guarantee. Seek legal advice before proceeding with cancellation. Ultimately, canceling a bank guarantee can provide financial relief and flexibility for a business, but it should be done with caution and careful consideration.

Conclusion:

Writing a bank guarantee cancellation letters can be a simple process if you follow a few basic guidelines. When cancelling a bank guarantee, it is important to ensure that you include all of the necessary details such as the account number, the guarantee amount, and the reason for cancellation. It is also important to send the cancellation letter to the correct department or person at the bank. Remember to keep a copy of the letter for your own records.

When writing a cancellation letter, some common mistakes to avoid include using unclear language or failing to provide all of the necessary information. It is important to be concise and direct in your letter, while still providing all of the relevant details.

To help you get started, we have included multiple free and ready-to-use templates for bank guarantee cancellation letters. These templates can be customized to meet your specific needs. You can save your time and effort when drafting your own letter.

Remember, when cancelling a bank guarantee, it is important to act promptly and professionally. By following these guidelines and using our templates as a starting point. You can ensure that your cancellation letter is effective and meets all of the necessary requirements.