In the world of finance, debt cancellation letters are an essential tool for individuals and businesses seeking to clear their outstanding debts. Such letters serve as formal requests to creditors to forgive or cancel a debt owed by the debtor. However, crafting a professional and appealing debt cancellation letter is critical, as it significantly impacts the success of the request. A well-written letter not only demonstrates the debtor’s sincerity and willingness to settle the debt but also shows respect for the creditor’s time and effort.

The importance of a good complaint letter cannot be overstated in the business world. A complaint letter serves as a formal way to voice dissatisfaction and communicate the problem to the concerned party. A well-crafted complaint letter can create an impact by providing a detailed description of the problem and its consequences, including any financial loss or damage. It also helps the recipient understand the extent of the problem and the urgency of addressing it. By presenting a clear and concise case, a complaint letter can prompt the recipient to take corrective action and avoid similar problems in the future.

Whether you are seeking to cancel a debt or make a complaint, a well-written letter can make all the difference. In this article, we will explore the importance of crafting a professional and appealing debt cancellation or complaint letter. We will discuss the key elements of such letters and provide tips for writing an effective letter that gets results. Whether you are a business owner seeking to clear outstanding debts or a consumer with a complaint, this article is for you. So, read on to discover how to create a letter that makes an impact and gets the results you want.

How To Write Debt Cancellation Letter?

Writing a debt cancellation letter is an essential step towards getting out of debt. It is important to craft a well-written letter that creates an impact and effectively communicates your request for debt cancellation.

Steps on How to Write the Best Debt Cancellation Letter:

- Start with a clear and concise statement: Begin your letter by stating your intention to request for debt cancellation. State the amount owed and the reason why you are unable to repay the debt.

Example: “I am writing to request for the cancellation of the $10,000 debt I owe on my credit card. Due to unforeseen circumstances, I am unable to make the monthly payments.”

- Provide relevant information: Include important details such as your account number, contact information, and any other relevant information that can help the creditor identify your account.

For Example: “My account number is XXXX-XXXX-XXXX-XXXX, and my contact information is listed below. I have been a loyal customer for several years and have always made timely payments on my account.”

- Express gratitude and request for debt cancellation: Thank the creditor for their understanding and support, and request for debt cancellation in a polite and respectful manner.

Example: “I sincerely appreciate your understanding and support during this difficult time. I humbly request that you consider cancelling my debt and releasing me from this financial burden.”

Conclusion: Writing a debt cancellation letter requires careful planning and attention to detail. By following these steps, you can create a well-crafted letter that effectively communicates your request for debt cancellation and helps you get out of debt.

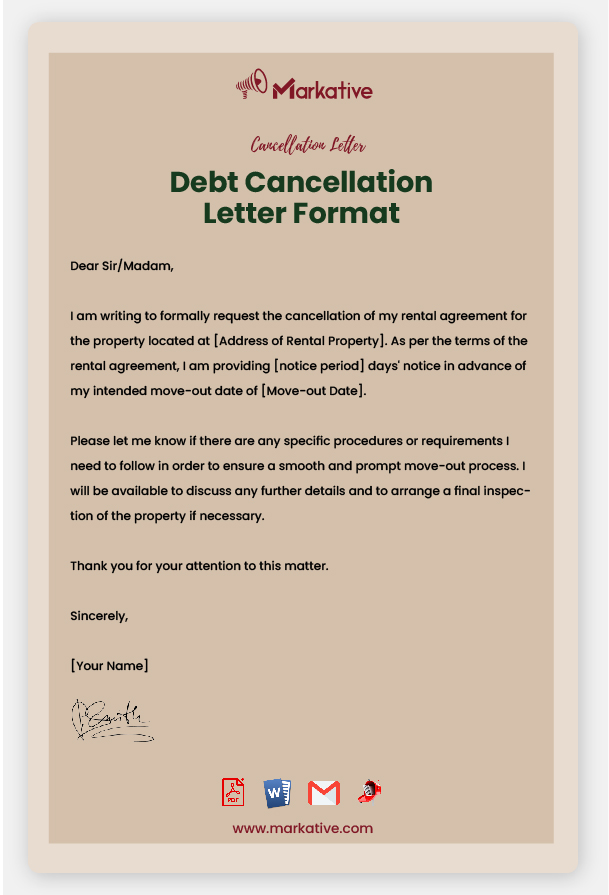

Debt Cancellation Letter Format

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Credit Card Company/Bank Name] [Address] [City, State ZIP Code] Subject: Request for Debt Cancellation Dear Sir/Madam, I am writing to request debt cancellation for my account [account number]. Due to [briefly explain the reason for the financial hardship], I am currently unable to meet my financial obligations and pay off my outstanding balance. I have been a loyal customer of [Credit Card Company/Bank Name] for [number of years] years and have always made timely payments in the past. However, my current financial situation has made it impossible for me to make payments on my account. I would greatly appreciate it if you could consider cancelling my debt in light of my current financial situation. This would provide me with some much-needed relief and help me get back on my feet. Please let me know if there is any additional information that you need from me to process my request. Thank you for your time and understanding. Sincerely, [Your Name]

For More: Best Credit Card Cancellation Letter [5+ Templates]

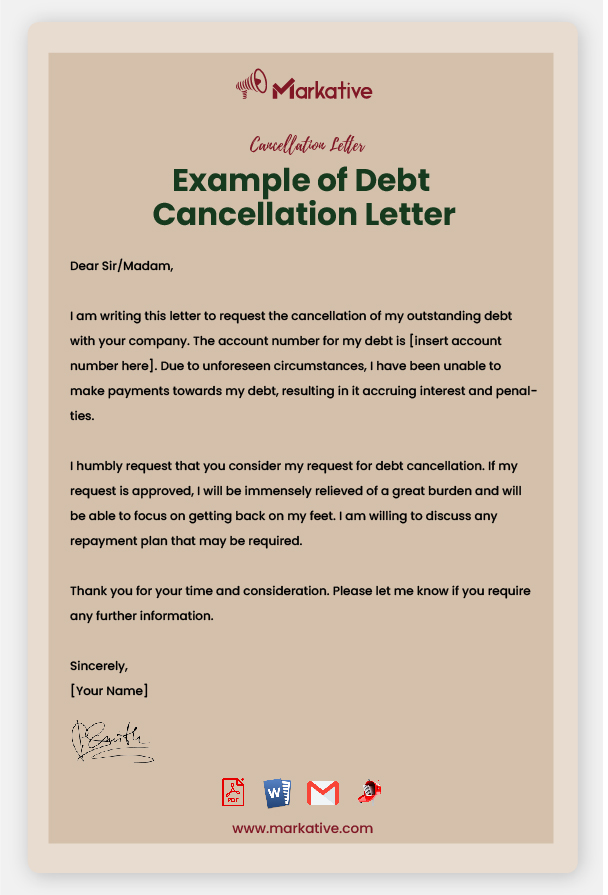

Example of Debt Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Name of Creditor] [Address of Creditor] [City, State ZIP Code] Dear Sir/Madam, I am writing this letter to request the cancellation of my outstanding debt with your company. The account number for my debt is [insert account number here]. Due to unforeseen circumstances, I have been unable to make payments towards my debt, resulting in it accruing interest and penalties. I am currently experiencing financial hardship and am unable to repay the debt in full. I have considered all available options and have come to the conclusion that debt cancellation is the only feasible solution for me at this time. I humbly request that you consider my request for debt cancellation. If my request is approved, I will be immensely relieved of a great burden and will be able to focus on getting back on my feet. I am willing to discuss any repayment plan that may be required. Thank you for your time and consideration. Please let me know if you require any further information. Sincerely, [Your Name]

For More: Best Complaint Letter Against Bank Charges [5 Free Samples]

Sample Debt Cancellation Letter

[Your Name] [Your Address] [City, State ZIP Code] [Date] [Debt Collector Name] [Debt Collector Address] [City, State ZIP Code] RE: Debt Cancellation Request Dear [Debt Collector Name], I am writing this letter to request the cancellation of the debt that I owe to your company. The account number associated with this debt is [insert account number]. I have been facing financial difficulties due to [briefly explain your financial situation]. This has caused me to fall behind on my payments and I am unable to pay the outstanding debt at this time. I am requesting that you cancel the debt owed in full, as I am currently unable to make any payments towards it. I understand that this may negatively impact my credit score, but I hope that you can understand my situation. I would like to thank you in advance for your consideration of my request. Please let me know if there are any further steps I need to take to complete this process. Sincerely, [Your Signature] [Your Name]

Debt Cancellation Letter Template

Dear Sir/Madam, I am writing to request debt cancellation for my account [account number]. Due to [briefly explain the reason for the financial hardship], I am currently unable to meet my financial obligations and pay off my outstanding balance. I have been a loyal customer of [Credit Card Company/Bank Name] for [number of years] years and have always made timely payments in the past. However, my current financial situation has made it impossible for me to make payments on my account. I am requesting that you cancel my outstanding balance of [amount of debt]. I would greatly appreciate it if you could consider cancelling my debt in light of my current financial situation. This would provide me with some much-needed relief and help me get back on my feet. I would like to emphasize that I am committed to paying off any future debts that I may incur, but I am currently facing unforeseen financial challenges that are beyond my control. Please let me know if there is any additional information that you need from me to process my request. I appreciate your understanding and assistance in this matter. Thank you for your time and consideration. Sincerely, [Your Name]

Effective Debt Cancellation Letter

Dear [Creditor], I am writing to request a cancellation of my outstanding debt with your company. Due to unforeseen circumstances, I am currently facing financial difficulties and am unable to make payments on my outstanding balance. I understand that I am responsible for the debt and am committed to resolving this issue as soon as possible. However, I am currently unable to fulfill my financial obligations at this time. I am requesting your understanding and consideration in canceling my debt. I assure you that I am committed to making every effort to improve my financial situation and to meet my future financial obligations. Thank you for your attention to this matter. Please contact me if you require any further information or have any questions. Sincerely, [Your Name]

When Should You Cancel a Debt Cancellation Letter

A debt cancellation letters should be canceled when it has been sent in error or the debt it was intended to cancel no longer exists. For example, if a creditor mistakenly sends a debt cancellation letters for a debt that was not actually paid off, the cancellation letters should be canceled and the debtor should be notified of the mistake.

Similarly, if a debt has already been paid off by the debtor or discharged in bankruptcy, a debt cancellation letters may no longer be necessary and should be canceled to avoid confusion. It is important to ensure that any cancellation of a debt cancellation letters is communicated clearly and promptly to all parties involved.

Reasons to consider canceling your Debt Cancellation Letters

Canceling your debt can be a wise decision for several reasons. Firstly, it can provide financial relief and reduce stress. Secondly, it can improve your credit score and financial stability. Lastly, it can free up funds for future investments and savings. In conclusion, carefully evaluating your financial situation and considering debt cancellation could lead to significant benefits.

Conclusion:

Writing a debt cancellation letters can be a straightforward process if you follow the proper steps. Remember to include all the necessary information, such as the creditor’s name and address, the account number, and the reason for the cancellation.

It is also important to check for any mistakes or errors before sending the letter. You should send the cancellation letter through certified mail to ensure that it is received by the creditor.

Finally, there are many free templates available that you can use to make the process even easier. Be sure to select a template that suits your needs and customize it to fit your situation. With these tips in mind, you can successfully cancel your debt and achieve financial freedom.